- Home

- Expat Guide

- Banking in Chile

- Checks in Chile

Last updated on 12/08/2025

While digital payments are rapidly growing in Chile (with debit cards accounting for 37% of POS transactions and the digital payments market growing by 11.24% annually), checks remain part of the payment ecosystem, particularly for business transactions and larger amounts.

However, there is a crucial security point to know regarding checks in Chile that can cost you a lot of money if overlooked.

How to lose money quickly with a check

In Chile, checks:

- can be exchanged for cash at any bank

- Have a mention on the right that says al portador, meaning anyone who has the check can cash it.

Conclusion: if you write a check to someone, and it gets stolen, the thief can cash it, and you're screwed.

To avoid this, when you receive a new checkbook, we advise you to:

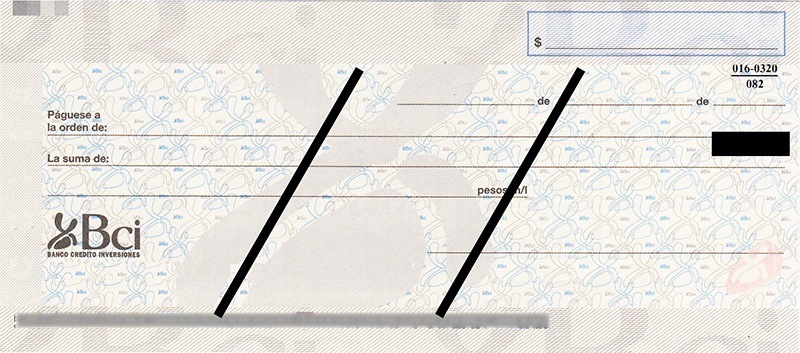

- Add two diagonal lines on each check: this prevents anyone from cashing it. All checks with diagonal lines will need to be deposited in an account

- Remove the two words al portador: this prevents anyone but the designated beneficiary from using it.

Yes, this is a bit tedious to do… but it's better to be safe.

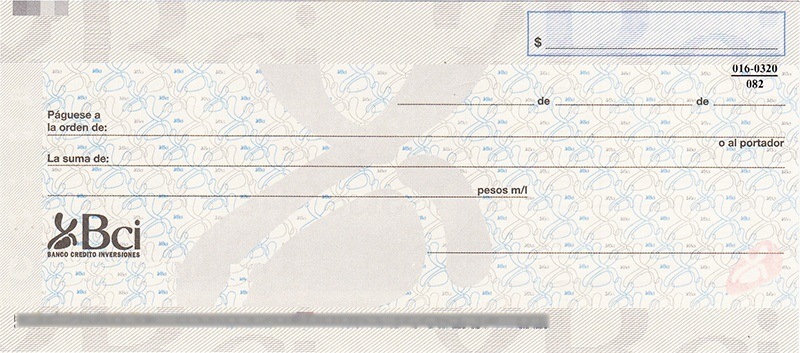

Here is a regular check (without the name/account number, of course) :

The safe version

Here is the modified and more safe version :

Ideally, this should be done on your entire checkbook as soon as you receive it. Otherwise, it is easy to forget, and when the check is issued, it is too late.